Home » Articles posted by Paul Goodrick (Page 2)

Author Archives: Paul Goodrick

Evaluating CSPR’s 700 MHz Auction Predictions

Late last year, all the way in October 2013, Canadian Spectrum Policy Research offered some educated guesses on how the auction might unfold as part of our review of the Canadian 700 MHz Auction process. As the auction is now complete, we thought we’d take a look at how we did.

While we didn’t offer a specific auction breakdown, two broad scenarios were explored.

SCENARIO 1

‘Prime’ Paired Blocks

Bell & TELUS = C1 / C2 Blocks

Rogers = C Block

Regional Carriers = B

‘Non-Prime’ Blocks

Rogers = D/E Blocks (Unpaired)

Unclaimed = A Block (Paired)

SCENARIO 2

‘Prime’ Paired Blocks

Bell & TELUS = C1 / C2 Block

Rogers = B Block

Regional Carriers = C

‘Non-Prime’ Blocks

Unclaimed = D/E Blocks (Unpaired)

Rogers = A Block (Paired)

Outcome & Evaluation

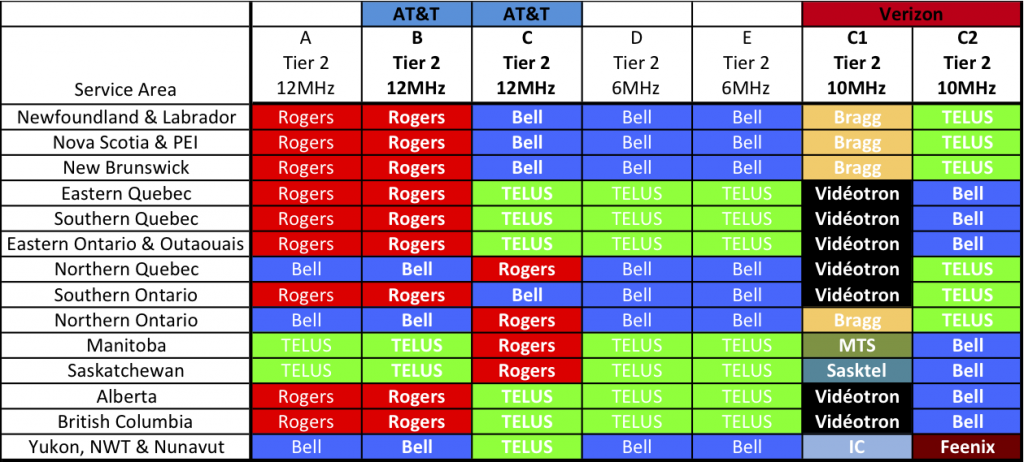

Image based on Industry Canada’s Overview.

Out of the two scenarios, the second was the closer of the two. Rogers secured the A & B blocks, and will be able to deploy LTE on 10MHz contiguous sub-1GHz channels across most of Canada. Rogers will indeed be able to access into AT&T’s device ecosystem, now that the US carrier is supporting Band 12.

In addition, Bell secured the C2 block throughout most of country, including all their key service areas. This should allow them to access similar devices as Verizon, though the interoperability is not as straightforward owing to differences in US and Canadian Band Plans.

In the end, Bell and TELUS secured the D & E blocks throughout the country. In Scenario 2, we suggested that it would be possible that no one would buy the unpaired spectrum. With the rapid growth in demand for mobile data, primarily due to video, and so soon after carriers throughout the world publicly worried about a “spectrum crunch”, it appears that Canadian carriers wanted to make sure they were able to secure all available spectrum, even if there is not yet a clear device ecosystem. If a device ecosystem does quickly materialize around LTE multicasting, securing both blocks of unpaired spectrum may allow Bell and TELUS a 10 MHz contiguous sub-1GHz channel at a low cost vis-à-vis Rogers paired blocks. Further, this appears to support Bell’s recent Mobile TV initiatives.

The one prediction that was incorrect was regional carriers securing the other lower paired block and Bell and TELUS focusing on C1 & C2. As companies are unable to discuss their auction behaviour for some months yet, we can only speculate reasons for this. One possible explanation is that it may have been a strategic decision to prevent Rogers from partnering with regional carriers to provide a contiguous 15 MHz channel and taking full advantage of Band 12 to deliver a potentially superior lower band offering.

Bell is currently able to offer a wide band for LTE in many parts of the country through their BRS spectrum holdings (as is Rogers) but it wouldn’t provide the same advantages in terms of building penetration and rural / remote coverage. TELUS does not currently have any BRS holdings and would be able to offer such an LTE connection until (potentially) after Industry Canada auctions off the rest of the BRS band, later this year or in 2015. Alternatively, TELUS would need to refarm already deployed spectrum, possibly by speeding up the sunsetting of their CDMA network. As noted above, the D & E unpaired blocks may have been seen as a sufficient substitute for a contiguous paired blocks.

Image based on Band Plan found in Industry Canada’s Policy and Technical Framework.

Although this image shows TELUS with 3 blocks adjacent, they could not provide a contiguous downlink. The uplink for the paired lower C block sits next to the unpaired (downlink) D & E blocks.

CSPR in the News: BNN | Headline

CSPR’s principal investigator, Gregory Taylor, was a guest on BNN’s Headline news segment (January 10, 2014) discussing the 2500 MHz spectrum auction announcement, and next week’s 700 MHz auction.

To watch the video, please see here.

Talking spectrum policy with the Canadian Media Guild

5 questions with Gregory Taylor: thinking boldly about our public airwaves

Today, the government will announce who will bid on the upcoming spectrum auction in January 2014. The CMG has urged the government to focus on what Canadians need from their airwaves, for example by reserving some spectrum in the 700 MHz band (the one to be auctioned) for public, community and educational use. Also of interest is the proposal this summer from Communications, Energy and Paperworkers Union of Canada (now merged in the new union, Unifor) that the government set up a fourth provider, a publicly-owned carrier in the interest of Canadians. These ideas are worth exploring if the goals of enhanced competition and access for Canadians who rely on these public airwaves are to be achieved.

…

See more at the Canadian Media Guild.

CSPR in the News: Anti-Verizon campaign

CBC’s The National ran a segment August 30th, 2013 regarding Verizon’s possible entrance into the Canadian mobile telecom space, featuring an appearance by CSPR’s own Greg Taylor.

The National | Anti-Verizon campaign

Newly united unions campaign against U.S. wireless firm entering Canada, Ron Charles reports

To watch the video, please see here.

CSPR in the News: Ruling the waves: Behind the telecos’ insatiable hunger for wireless spectrum

Dr. Taylor was recently quoted in this Financial Post article:

Gregory Taylor, principal investigator for Canadian Spectrum Policy Research, a research team at Toronto’s Ryerson University, says with 20-year licence terms at stake, decisions on spectrum policy being made now will shape Canada’s digital infrastructure for a long time to come.

“A key point has got to be that this is a public resource and we often forget about that,” he says.

…

“The average Canadian tends to look at this from how it will affect their monthly bill – so a big company with deep pockets like Verizon can come in and not just participate in the auction but possibly dominate it and become instantly a large carrier across the country,” spectrum researcher Mr. Taylor says.

But he adds that there are real concerns about the U.S. carrier’s long-term commitment to Canada and whether it would build in rural areas.

Plus, while it has huge buying power due to its 100 million wireless subscribers and could provoke price competition in Canada, financial analysts note that Verizon is a premium carrier in the United States and not likely to bring a discount model north of the border.

“I think that to look upon the arrival of Verizon as some sort of saviour of the Canadian system is a bit naïve,” Mr. Taylor says. “On the other hand, most Canadians have no great love for the domestic incumbents either.”

CSPR in the News: Telus CEO Entwistle warns of ‘bloodbath’ if Verizon has advantage in wireless spectrum auction

Dr. Taylor was recently quoted in this Financial Post article:

The Conservative Party of Canada used the Telus decision as an opportunity to highlight its achievements on cellphone bills in an email to supporters, and Prime Minister Stephen Harper addressed the issue on his Facebook page last month.

“Stephen Harper doesn’t say a thing without it being well calculated. He’s well aware that this is a winner for the government,” said Gregory Taylor, principal investigator for Canadian Spectrum Policy Research, a research team at Toronto’s Ryerson University.

“If they can score political points while knocking around Rogers and Bell while still allowing Rogers and Bell to reap record profits, it’s a great win for the government.”

CSPR in the News: Wind CEO denies wireless rules hurt Big Three

Dr. Taylor’s below article served as a source for this news article published in Canada’s Globe & Mail.