Home » Articles posted by Paul Goodrick

Author Archives: Paul Goodrick

CSPR in the News: Spectrum auction winners and losers

CSPR’s own Gregory Taylor was a guest on BNN providing some analysis on Canada’s just completed AWS-3 spectrum auction.

Gregory Taylor, the principal investigator at the Canadian Spectrum Policy Research at Ryerson University says the Canadian market is nowhere close to Ottawa’s vision for a viable fourth player at the national scale, but strong regional players are filling that void.

“The spectrum in Saskatchewan and Manitoba wasn’t even sold today because they have a fourth carrier in those markets that were seen as too large to be seen as new carriers,” he said.

To watch the video, please see here.

Unpacking Industry Canada’s December 2014 Announcements (Part III)

On December 18th, 2014, Industry Minister James Moore announced a number of measures concerning spectrum for mobile communications in Canada. In fact, there were six different initiatives announced that are slated to take place during 2015. Not all spectrum is created equal though, so let’s take a closer look at the individual announcements.

Below are the 3500 MHz and AWS-4 announcements. For the AWS-3 and 600 MHz announcements, please see here. For the 3500 MHz and AWS-4 announcements, please see here.

5. Backhaul spectrum decision

Most wireless communication needs a wire, sooner or later. (Mesh and peer-to-peer networks are two examples of newer, limited, communication networks that do not.) Backhaul is the essential infrastructure that connects base stations to the core network of fixed and mobile telecommunication systems, or is used to interconnect remote sites and buildings across a wide range of industries. Backhaul can be composed of various technologies including fibre, microwave, satellites, cable, and leased lines (eg, copper telephone lines, DSL, etc). Fibre tends to be ‘the best’ backhaul technology due to large capacity and high reliability but wireless backhaul (generally in the form of microwave) is another critically important technology in remote/rural areas, for fast deployment of cells in urban areas, and to provide transmission across varied topography.

Microwave Dish (drum shape, center) used for Wireless Backhaul

The three primary user groups of backhaul are telecom & internet service providers; electrical utilities; and, broadcasters. With the growth of internet usage for both wired and wireless users, the introduction of smart grids and increase in (often remote) power generation sites, and changing needs broadcasters for video gathering and distribution at ever higher resolution, the demand for backhaul by all groups continues to increase. Industry Canada launched a consultation in December 2012 to explore spectrum utilization policies and technical requirements related to backhaul spectrum in various bands, with an emphasis on supporting the deployment of wireless broadband services across Canada.

In December 2014, the department announced a number of decisions that help modernize Canada’s backhaul regulatory framework, revising various existing spectrum utilization policies, regulations and technical standards. In addition, Industry Canada announced an additional 2100 MHz of backhaul spectrum including 500 Mhz in the 4 GHz band (great for rural/remote backhaul coverage) and 1600 MHz in the 32 GHz band (ideal for supporting urban backhaul capacity).

6. 24/28/38 GHz decision

This decision relates to the previous backhaul spectrum announcement, specifically providing a New Licensing Framework for the 24, 28 and 38 GHz Bands and Decision on a Licence Renewal Process for the 24 and 38 GHz Bands.

Parts of the 24 and 38 GHz band had been previously auctioned by Industry Canada in 1999. While some licensees have deployed backhaul using the spectrum, a number of them have either not met all the original deployment requirements or only partially deployed. Industry Canada noted that in recognition of an earlier lack of suitable and affordable equipment, Industry Canada provided a term extension and two deployment extensions. As such, only where all conditions of licence for the auctioned 24 and 38 GHz licences have been met, will licensees be eligible to be issued new licences.

Not all this backhaul spectrum was auctioned in 1999, as only 260 of the 354 licences were successfully awarded for Tier 3 Service Areas. Since then Industry Canada has awarded licences in the 24 and 38 GHz band on first-come, first-served (FCFS) site specific licences, which allowed carriers to obtain backhaul spectrum in limited areas to help fill network coverage gaps. Industry Canada will continue to use a FCFS site-specific licensing framework for all available spectrum (unassigned and returned) in the 24, 28 and 38 GHz bands. In addition, all spectrum in these bands newly licensed and renewed through the framework will be subjected to the Conditions of Licence, which include initiatives such as Mandatory Antenna Tower and Site Sharing that were not in place at the time of the 1999 auction.

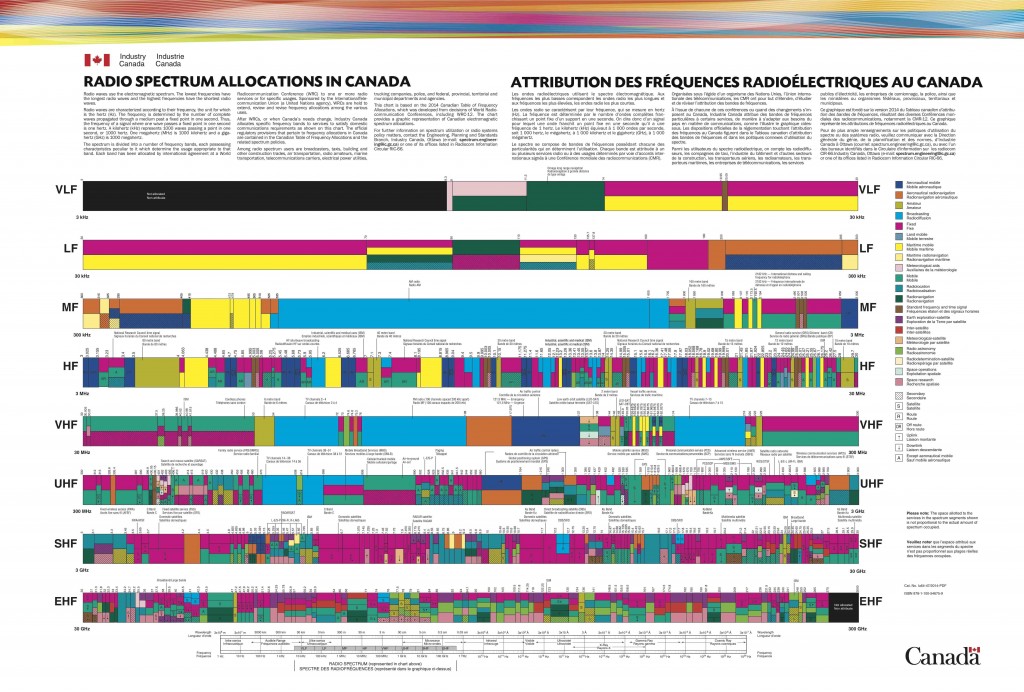

Industry Canada: Canadian Table of Frequency Allocations 2014

Unpacking Industry Canada’s December 2014 Announcements (Part II)

On December 18th, 2014, Industry Minister James Moore announced a number of measures concerning spectrum for mobile communications in Canada. In fact, there were six different initiatives announced that are slated to take place during 2015. Not all spectrum is created equal though, so CSPR offers some context for the individual announcements.

Below are the 3500 MHz and AWS-4 announcements. For the AWS-3 and 600 MHz announcements, please see here.

3. 3500 MHz decision

This band is currently used in Canada primarily to provide fixed wireless access (FWA) in rural/remote areas. FWA covers a number of technologies that serve to provide wireless last mile telecom connectivity where portability isn’t needed. Think home internet for someone living in a remote resource town or on a rural farm. FWA isn’t the only usage of the 3500 MHz band though, other incumbents include: amateur stations; radiolocation systems; fixed satellite service (FSS) earth stations; and, fixed point-to-point systems.

Perhaps the most well known rural/remote internet provider in Canada is Xplornet, which provides FWA and satellite connectivity. It uses the 3500 MHz band to provide rural FWA connections and a combination of leased Ku-band (12-18 GHz) and Ku-band (26.5-40 GHz) satellites to provide to remote satellite connections.

While many service providers use the band throughout rural/remote areas, an abundance of wired access options (telephone lines, DSL, cable, fibre) meant that 3500 MHz band was often unused in urban settings. With an increasing demand for spectrum mobile services, Industry Canada launched a consultation in August 2014 on future uses of the 3500 MHz band. This caused a lot of concern for rural FWA ISPs and their customers. During the consultation process, the Government moved forward with the Connecting Canadians initiative that will provide funding to build or extend high-speed internet (5Mbps) for rural/remote consumers, including a specific Northern Component.

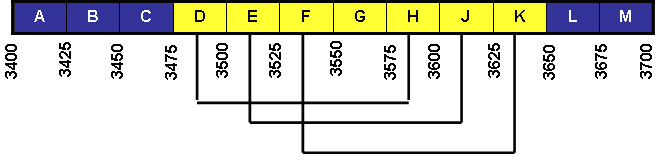

Existing Canadian 3500 MHz band plan

The major decision of the consultation is that the department will be “fundamentally reallocating the 3500 MHz band to allow mobile services throughout the band.” Further consultations will be required to determine the new ‘flexible use band plan’ that will allow FWA, mobile and other services to co-exist. In an effort to reassure rural/remote customers and ISPs, Industry Canada stated, “the new licensing framework will include a measure to allow existing FWA licensees, who are in compliance with all existing licence conditions, to have a high expectation of spectrum licences under the 3500 MHz flexible use policy, facilitating their ability to provide services.”

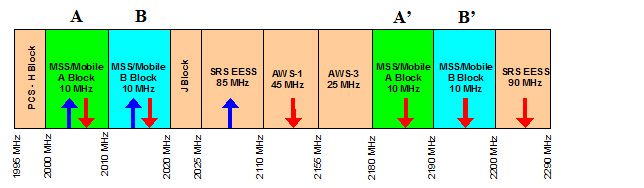

4. AWS-4 decision

Industry Canada launched a consultation in May 2014 on the AWS-4 spectrum (2000-2020 & 2180-2200 MHz), due to changes in how the FCC was managing the band. AWS-4 is allocated for Mobile-Satellite Service (MSS), along with Ancillary Terrestrial Component (ATC) — ground-based infrastructure that complements the MSS service. Services currently being provided by two geostationary satellites in orbit include mobile communications for both government and business customers and satellite television and internet across Canada and the US. The satellites are both owned by US-based DISH Network, which also owns the Canadian satellite operator that provides services to Canadian customers.

The AWS-4 changes in both the US and Canada were precipitated by the FCC licensing the PCS H block (1915-1920/1995-2000 MHz) for land-based mobile communications, which would likely cause interference to the adjacent MSS. In keeping with Industry Canada policy of largely harmonizing spectrum management with the US (to minimize interference issues), the department issued a number technical and licensing updates while affirming the requirement to provide Mobile-Satellite Service in the band. This is to help insure that licensees do not focus on providing ATC services and clients (both government and businesses) that depend on satellite-based services have options. In addition, stricter deployment conditions were added to ensure timely initial roll-out of services (5 years) and continuation of service (4 years) if a satellite suffered catastrophic failure and needed to be replaced.

Unpacking Industry Canada’s December 2014 Announcements (Part I)

On December 18th, 2014, Industry Minister James Moore announced a number of measures concerning spectrum for mobile communications in Canada. In fact, there were six different initiatives announced that are slated to take place during 2015. Not all spectrum is created equal though, so CSPR offers some context for the individual announcements.

Here’s the first two on AWS-3 and 600 MHz.

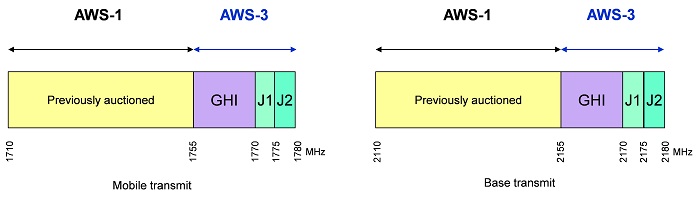

1. AWS-3 Auction Decision

Canada’s AWS-3 spectrum auction is now scheduled to begin on March 3, 2015. The US completed their AWS-3 auction on January 29, 2015, raising a massive $45 billion in total bids, but there are significant differences between the two. Industry Canada has reserved 30MHz (block GHI, 15x15MHz) for “operating new entrants“, with 20MHz (blocks J1 & J2, 5x5MHz) open to all bidders. This policy is known as a ‘set aside’, which can be used to favour different carriers. (In 2008’s AWS auction, a set aside was used to encourage new market entrants. The AWS-3 set aside is designed to increase competition by allowing current “new entrants” to acquire more spectrum at lower prices.)

The Canadian band plan differs from the FCC’s band plan, which had no set asides. The US auctioned the G, H, and I blocks separately as 5x5MHz blocks and combined the J block (10x10MHz). Their auction also included two unpaired blocks (a 5MHz and 10MHz block) that Industry Canada is not auctioning at this time.

Canadian AWS-3 Band Plan

These differences mean that Canada will not receive relatively comparable auction prices. In addition, since some the licence areas do not have an operating new entrant there will be a number of licences left unawarded. Industry Canada has proposed a future consultation process to determine how to deal with any unawarded licences.

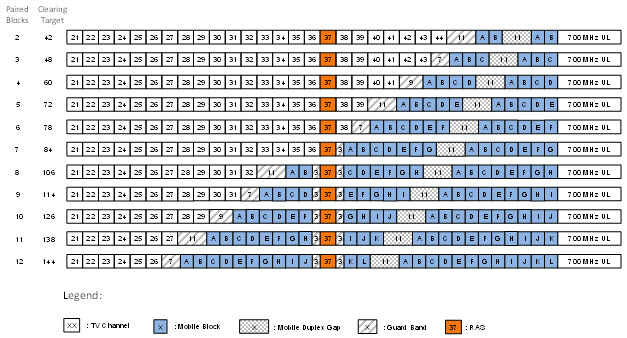

2. 600 MHz consultation

In 2014, Industry Canada auctioned off spectrum in the 700 MHz band as part of the Digital Dividend. This spectrum had previously been allocated for over-the-air (OTA) television broadcast but the switch to digital broadcasting allowed television stations to transmit TV signals more efficiently, resulting in ‘leftover’ spectrum that was re-allocated for mobile communications. With Cisco reporting Canada’s mobile data traffic increased 59% in 2014, the spectrum reserved for OTA television has growing value. Exact numbers are unavailable but less than 10% of Canadians receive their television via an antenna.

The CRTC recently affirmed their commitment to OTA, noting its importance to the Canadian broadcasting system — to local and Canadian programming, in particular — but they also recognized “that in light of changing technology and new platforms for broadcasting, reliance on over-the-air television reception may diminish in the future.” Industry Canada is launching a consultation as part of its decision-making process on a possible reallocation of the 600 MHz band from OTA to mobile. Perhaps the most important aspect of the consultation for Industry Canada is how closely we should align with US efforts in the band.

Unlike typical spectrum reallocations, the FCC is planning an ‘incentive auction‘ for the 600 MHz band that would, in fact, be two simultaneous auctions. Television broadcasters will participate in a reverse auction to determine at what price, if any, they would be willing to voluntarily return their broadcast licence to the FCC. Carriers will be participating in a forward auction to indicate what price they would be willing to pay for a mobile licence in the band. Broadcasters have other options besides simply returning their licence, such as bidding to move to an OTA channel lower on the dial or sharing a channel through signal duplexing. As one might imagine, it will be a very complex process.

Proposed 600 MHz Band Plan Options

The FCC 600 MHz incentive auctions will not take place prior to 2016 and many details are still to be determined. Between 20 and 120 MHz could repurposed for commercial mobile but the final amount will not be known until after the auction. The FCC and Industry Canada will work together to minimize/eliminate potential cross-border interference but to allow for the most efficient reallocation — protecting all broadcasters who want to retain their OTA licences while maximizing the amount of spectrum for commercial mobile — it would be best for both countries to conduct a joint repacking process.

CSPR’s Gregory Taylor at the CRTC “Let’s Talk TV” Hearings

Dr. Taylor spoke before the national media regulator on September 16 on the subject of the future of over-the-air television in Canada. He argued that Canadian OTA broadcasters are not making efficient use of their assigned 6 MHz of public spectrum and, as a result, Canadians are missing out on the true potential of digital OTA broadcasts. As the CRTC considers ending over-the-air transmission altogether, Taylor argues perhaps Canadians should first see what a true digital OTA system looks like. Transcript available here.

2014 Canadian Telecom Summit — What spectrum crunch?

The Canadian Telecom Summit (CTS) is an annual industry conference focusing on the telecommunication, IT, and broadcasting industries. The conference brings together senior executives, along with policy makers, regulators, and industry analysts to discuss key issues and trends that will impact this critical sector of the Canadian economy. While government officials from various areas (including the CRTC, Industry Canada, Heritage, and the Prime Minister’s Office) often attend, they are not active presenters or panelists. Thus, the CTS serves as part of the regular, routine contacts between government and business that can influence policy decisions, along with facilitating communication between infrastructure manufacturers, business service providers, and carriers and internet service providers (ISPs).

For a researcher focused on spectrum policy, it was interesting to observe that very little of this year’s Canadian Telecom Summit put much emphasis on spectrum. It existed on the periphery but largely just as one of many factors that networks require to meet the growing bandwidth demands of mobile broadband. MTS’s CEO noted that the 700 MHz auction rules favoured national carriers at the expense of regional carriers in context of the Harper government’s 4th carrier policy. WIND Mobile’s CEO also talked about the need to get access to spectrum to roll out LTE but, once again, in the competition lens of a 4th national carrier.

The CTS is primarily an industry conference, so focused on current dynamics in the commercial/consumer sector. The 700 MHz auction wrapped up earlier this year (February) and the 2500 MHz auction is still 10 months away. The July 7th AWS-3 announcement by Industry Canada to hold another auction in-between appears to have genuinely caught industry watchers and participants by surprise. Even rumours of such a possibility were nowhere to be heard at CTS. So, understandably, spectrum availability was not of high priority — or at least debate/discussion — at the summit.

At the always lively ‘Regulatory Blockbuster’ panel, most of the debate took place around wholesale domestic roaming and network access issues — areas that the CRTC is currently considering. Whether panelists were incumbents (Rogers, Bell, TELUS), new entrants (WIND), or representing independent ISPs (Tacit), largely dictated their positions and speaking points. Failure of new entrants and startups to move up the investment ladder in facilities-based competition was highlighted by the incumbents. Speaking points for non-incumbents included regulated access for cablecos on incumbent local exchange carrier (ILEC) networks during their startup phase, Canada’s increasing underperformance in broadband speeds and price/value, and use of domestic roaming rates as an anti-competitive tactic.

From a policy analysis lens, this presents a few serious challenges. Power asymmetries between incumbents and challengers are emphasized when issues are dealt with on an individual basis and comprehensive sectoral policy is not reviewed. The more specificity is employed — the narrower the policy issue — the more it allows more powerful actors to make ‘reasonable’ arguments and extract more concessions. It also can result in satisficing by policy makers, meeting the minimum requirements for achieving a particular result without fully exploring/pursuing more optimal options.

On the issue of wholesale network access, Jonathan Daniels (VP, Regulatory Law, Bell) argued that unlike DSL internet-access, there was no legacy benefit to fibre to the home/node (FTTH/FTTN). Which is ‘reasonable’, since incumbents are deploying the FTTH connection for new customers only when requested for existing residences and businesses. But it also ignores incumbent right-of-way access and switching station facilities that are part of legacy copper line deployments.

Right-of-way access in this case refers to the ability of utility companies (ISPs, WSPs, telcos, and cablecos) to run network wires under and above ground on public and private land and have guaranteed access, necessary to build and maintain telecommunications infrastructure. Telecom companies that were originally telephone (or cable) companies often built their original networks as a monopoly, and have maintained right-of-way access sometimes for more than 100 years. To limit the amount of tearing up of roads and properties, governments will often mandate incumbents provide access to these ‘local loop’ or ‘last-mile’ connections/infrastructure.

Ted Woodhead (SVP, Federal Government & Regulatory Affairs, TELUS) argued that Industry Canada’s ‘changing of the rules’ around the transfer of AWS spectrum set-aside had negative consequences for investment. (Simon Lockie, Chief Regulatory Officer, WIND Mobile, suggested this was more a case of government clarifying, rather than changing, rules.) This may be true but this ‘changing of the rules’ impacts foreign investors more and, in fact, likely improves incumbents’ access to domestic capital markets.

Industry Canada’s Digital Canada 150 strategy — a document named for Canada’s age, not anywhere near the policy’s broadband speed targets — continues this satisficing policy making. Canada’s government policy is too narrowly focused on individual issues and not truly a roadmap to achieving the Telecommunication Act’s policy objectives in an ambitious and/or strategic manner.

In this regard, the ‘spectrum crunch’ argument made in the run up to the 700MHz auction appears to be even more a tactic by incumbent carriers to disaggregate telecommunication policy in order to maximize their asymmetric position in the sector — especially with the high-value, low-band spectrum available in that auction. Such behaviour by incumbents is both rational and justified to protect their corporate interests. And it is not solely directed towards new entrants. WIND’s Lockie noted in his CTS presentation several examples of inter-modal incumbent regulatory competition:

- Cost-based rates for access to support structures (poles, strands, ducts), duplication of which can be unsightly or disruptive for communities [cable company initiative opposed by ILECs];

- ILEC demands for fair access to Multiple Dwelling Units leading to the “MDU Condition” to promote choice for end-users [LECs v. cable co’s];

- Vertical Integration rules governing access to content held by integrated operators [content rich BDU’s v. content poor BDU’s].

Source: WIND Mobile. Regulatory Blockbuster Panel [Slide Deck]. 2014 Canadian Telecom Summit.

Rogers’ Ken Engelhart (SVP, Regulatory, Rogers Communications) argued the regulatory system should be about consumers and that government should remove barriers to competition but should not help individual competitors. The crux of his position was, “Incentives matter. Countries with high levels of wholesale regulation invest less and have second-class networks.” (Source: Rogers Communications, Regulatory Blockbuster Panel [Slide Deck]. 2014 Canadian Telecom Summit.)

The problem is that government should not be focused solely on investment levels, as this only tells part of the story. While Rogers, TELUS, and Bell all used examples of Europe vis-à-vis North America, data was selectively used and given with no context. Less investment could be the result of less duplication of infrastructure. “Second-class networks” is a euphemism for lack of LTE but this is more the result of greater challenges coordinating spectrum policy across individual countries, and a hangover the financial Euro crisis. Germany, one of the first EU countries to allot spectrum for LTE and with a strong economy, has comparable mobile download speeds and broad LTE network coverage.

It is up to government and regulators to be more holistic in policy development and weigh the benefits and costs to consumers and citizens more broadly.

CSPR in the News: Wither Over-the-Air?

CSPR’s Gregory Taylor comments for the Globe and Mail regarding potential impacts of the CRTC’s Let’s Talk TV initiative for pick-and-pay TV and over-the-air (OTA) TV.

Rogers and Shaw both disagree, saying it is too soon to abandon these free signals. Gregory Taylor, a researcher at Ryerson University and author of Shut Off: the Canadian Digital Television Transition, agrees the number of households that rely on it is still high.

“To discontinue over-the-air distribution would be to further remove a substantial sector of the population from the broadcasting system that has been, in theory and in law, designed to serve the wider public interest,“ he said in a submission.

CSPR in the News: Pick-and-Pay TV

CSPR’s principal investigator, Gregory Taylor, was a guest on BNN’s Business Day PM segment (June 30, 2014) discussing how Canada’s TV landscape could change in a pick-and-pay model, and potential impacts on the Canadian media industry.

To watch the video, please see here.

CSPR researcher shortlisted for Donner Book Prize

CSPR’s primary investigator Gregory Taylor was nominated to the final five for his book, Shut Off: The Canadian Digital Television Transition (McGill-Queen’s University Press, 2013). Shut Off examined the technology and policies involved with Canada’s switch from analogue to digital television broadcasting, which cleared the 700MHz band for 2014’s Mobile Broadband Services (MBS) spectrum auction.

The Donner Book Prize annually rewards excellence and innovation in public policy writing by Canadians.

CSPR in the News: Péladeau’s move into political spotlight casts doubt on Ottawa’s wireless victory

Dr. Taylor weighs in for the National Post on the announcement that Quebecor’s (parent company of wireless provider Vidéotron) Pierre Karl Péladeau will run for office in Quebec.

“If [Mr. Péladeau] is going to be really pushing for sovereignty, it has real implications for spectrum that [Quebecor] holds across the country,” Mr. Taylor said. “I don’t think anybody in the government thought this was coming a month ago when they were declaring the spectrum auction was a great victory.”