On December 18th, 2014, Industry Minister James Moore announced a number of measures concerning spectrum for mobile communications in Canada. In fact, there were six different initiatives announced that are slated to take place during 2015. Not all spectrum is created equal though, so CSPR offers some context for the individual announcements.

Here’s the first two on AWS-3 and 600 MHz.

1. AWS-3 Auction Decision

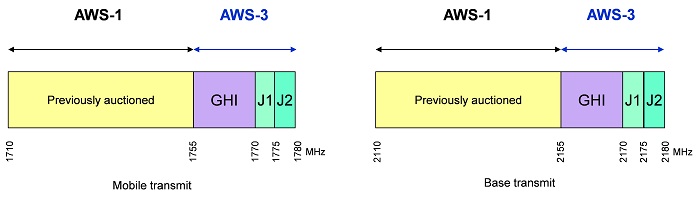

Canada’s AWS-3 spectrum auction is now scheduled to begin on March 3, 2015. The US completed their AWS-3 auction on January 29, 2015, raising a massive $45 billion in total bids, but there are significant differences between the two. Industry Canada has reserved 30MHz (block GHI, 15x15MHz) for “operating new entrants“, with 20MHz (blocks J1 & J2, 5x5MHz) open to all bidders. This policy is known as a ‘set aside’, which can be used to favour different carriers. (In 2008’s AWS auction, a set aside was used to encourage new market entrants. The AWS-3 set aside is designed to increase competition by allowing current “new entrants” to acquire more spectrum at lower prices.)

The Canadian band plan differs from the FCC’s band plan, which had no set asides. The US auctioned the G, H, and I blocks separately as 5x5MHz blocks and combined the J block (10x10MHz). Their auction also included two unpaired blocks (a 5MHz and 10MHz block) that Industry Canada is not auctioning at this time.

Canadian AWS-3 Band Plan

These differences mean that Canada will not receive relatively comparable auction prices. In addition, since some the licence areas do not have an operating new entrant there will be a number of licences left unawarded. Industry Canada has proposed a future consultation process to determine how to deal with any unawarded licences.

2. 600 MHz consultation

In 2014, Industry Canada auctioned off spectrum in the 700 MHz band as part of the Digital Dividend. This spectrum had previously been allocated for over-the-air (OTA) television broadcast but the switch to digital broadcasting allowed television stations to transmit TV signals more efficiently, resulting in ‘leftover’ spectrum that was re-allocated for mobile communications. With Cisco reporting Canada’s mobile data traffic increased 59% in 2014, the spectrum reserved for OTA television has growing value. Exact numbers are unavailable but less than 10% of Canadians receive their television via an antenna.

The CRTC recently affirmed their commitment to OTA, noting its importance to the Canadian broadcasting system — to local and Canadian programming, in particular — but they also recognized “that in light of changing technology and new platforms for broadcasting, reliance on over-the-air television reception may diminish in the future.” Industry Canada is launching a consultation as part of its decision-making process on a possible reallocation of the 600 MHz band from OTA to mobile. Perhaps the most important aspect of the consultation for Industry Canada is how closely we should align with US efforts in the band.

Unlike typical spectrum reallocations, the FCC is planning an ‘incentive auction‘ for the 600 MHz band that would, in fact, be two simultaneous auctions. Television broadcasters will participate in a reverse auction to determine at what price, if any, they would be willing to voluntarily return their broadcast licence to the FCC. Carriers will be participating in a forward auction to indicate what price they would be willing to pay for a mobile licence in the band. Broadcasters have other options besides simply returning their licence, such as bidding to move to an OTA channel lower on the dial or sharing a channel through signal duplexing. As one might imagine, it will be a very complex process.

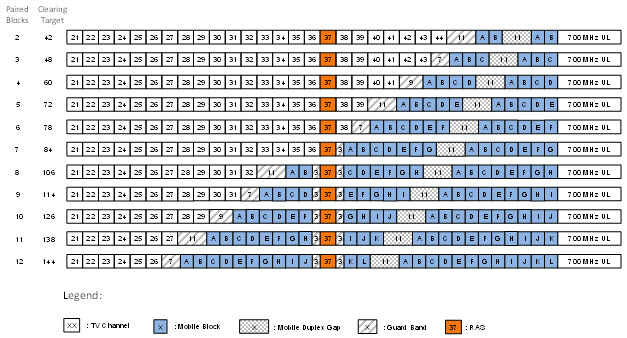

Proposed 600 MHz Band Plan Options

The FCC 600 MHz incentive auctions will not take place prior to 2016 and many details are still to be determined. Between 20 and 120 MHz could repurposed for commercial mobile but the final amount will not be known until after the auction. The FCC and Industry Canada will work together to minimize/eliminate potential cross-border interference but to allow for the most efficient reallocation — protecting all broadcasters who want to retain their OTA licences while maximizing the amount of spectrum for commercial mobile — it would be best for both countries to conduct a joint repacking process.